Dental Debt Collection - Truths

Wiki Article

All about Personal Debt Collection

Table of ContentsPersonal Debt Collection - TruthsWhat Does Dental Debt Collection Do?Rumored Buzz on Dental Debt CollectionFacts About Debt Collection Agency Uncovered

A financial obligation enthusiast is an individual or organization that remains in the company of recovering cash owed on delinquent accounts. Numerous financial debt enthusiasts are worked with by firms to which money is owed by individuals, operating for a level cost or for a percent of the quantity they have the ability to gather.

A financial debt collector might also be called a collection agency. Here is exactly how they function. A debt collector attempts to recuperate past-due financial obligations owed to financial institutions. Financial debt collection agencies are usually paid a percent of any kind of money they take care of to collect. Some debt enthusiasts purchase delinquent financial debts from creditors at a discount and after that seek to gather by themselves.

Financial debt collection agencies who break the regulations can be taken legal action against. At that point the financial debt is claimed to have gone to collections.

Overdue payments on bank card balances, phone expenses, automobile lendings, energy expenses, as well as back tax obligations are examples of the delinquent financial debts that an enthusiast might be charged with retrieving. Some companies have their own financial debt collection divisions. The majority of discover it much easier to hire a financial obligation enthusiast to go after overdue financial debts than to chase the clients themselves.

The smart Trick of Dental Debt Collection That Nobody is Talking About

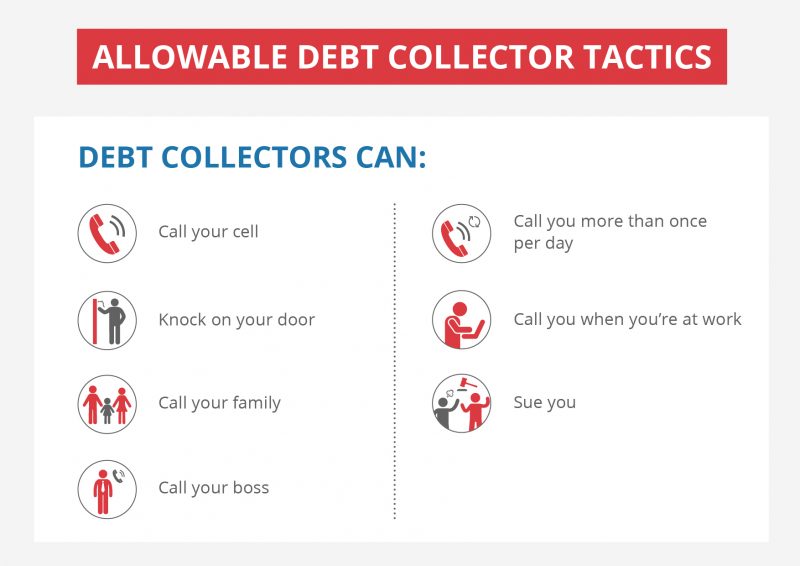

Debt collection agencies may call the person's personal and also work phones, as well as also show up on their front door. They may additionally contact their family members, friends, as well as next-door neighbors in order to validate the call details that they have on file for the individual.m. or after 9 p. m. Nor can they incorrectly claim that a debtor will be apprehended if they fail to pay. Additionally, a collector can't physically damage or endanger a borrower and isn't permitted to confiscate assets without the approval of a court. The regulation also offers borrowers certain legal rights.

People that assume a financial obligation enthusiast has actually damaged the regulation can report them to the FTC, the CFPB, and their state attorney general of the United States's office. They additionally can sue the financial obligation collection agency in state or federal court. Yes, a financial obligation enthusiast might report a financial obligation to the credit bureaus, however only after it has actually spoken to the borrower concerning it.

Both can continue to be on credit score records for up to seven years as well as have an unfavorable impact on the person's credit rating, a large part of which is based upon their settlement history. No, the Fair Financial Obligation Collection Practices Act uses just to consumer financial debts, such as mortgages, credit report cards, auto loan, trainee car loans, as well as clinical costs. my blog

What Does Dental Debt Collection Mean?

When that occurs, the IRS will send the taxpayer an official notification called a CP40. Due to the fact that frauds are common, taxpayers need to watch out for anybody claiming to be working with part of the IRS as well as talk to the IRS to see to it. That relies on the state. Some states have licensing demands for financial debt collectors, while others do not.Debt collectors offer a helpful solution to lenders and various other financial institutions that wish to recover all or part of money that is owed to them. At the same time, the law you could check here gives particular consumer securities to maintain financial obligation collection agencies from becoming as well hostile or abusive.

Generally, this information is provided in a written notification sent as the initial communication to you or within five days of their initial interaction with you, and it may be sent by mail or digitally.

This notice generally should consist of: A declaration that the communication is from a financial debt collection agency, Your name as well as mailing information, along with the name and mailing information of the financial debt collection agency, The name of the creditor you owe the debt to, It is feasible that more than one financial institution will be detailed, The account number connected with the debt (if any kind of)A breakdown of the current amount of the financial obligation that shows rate of interest, costs, payments, and credits since a specific date, The existing amount of the financial debt when the notification is provided, Details you can utilize to respond to the financial debt collector, such as if you believe the financial debt is not yours or if the quantity is incorrect, An end date for a 30-day period when you can challenge the financial obligation, You might see various other info on your notice, however the information detailed over normally must be consisted of.

The Best Guide To Business Debt Collection

Discover more concerning your debt collection securities..

State, you don't pay a charge card bill for one or even more billing cycles. A rep of that card provider's collection department might connect to demand payment. When a financial debt goes overdue for a number of months, the original creditor will certainly frequently market it to an outdoors company. The purchaser is referred to as a third-party financial debt collection agency."Collection company" is another term additional info used to explain third-party debt collectors.

:max_bytes(150000):strip_icc()/5-things-debt-collectors-are-forbidden-do.aspFinal-634f6e5d829d477ea784381d5cbf8bf6.jpg)

The FDCPA legally establishes what debt enthusiasts can and also can't do. They have to tell you the amount of the financial debt owed, share details regarding your legal rights as well as clarify exactly how to contest the financial debt. They can additionally sue you for repayment on a financial debt as long as the law of restrictions on it hasn't expired.

Report this wiki page