Choose Credifin for Effective Financial Obligation Collection and Resolution

Wiki Article

Proven Techniques for Lending Collection: Trust the Specialists

Aiming to enhance your funding collection strategies? Trust fund the experts who have actually verified methods for successful financial debt healing. In this post, we will certainly direct you through the funding collection process, offering effective communication methods, arrangement methods, and ideas on making use of innovation. Discover ideal techniques for legal actions in finance collection. By following these expert strategies, you can enhance your collection initiatives as well as enhance your opportunities of recuperating superior financial debts.Recognizing the Finance Collection Process

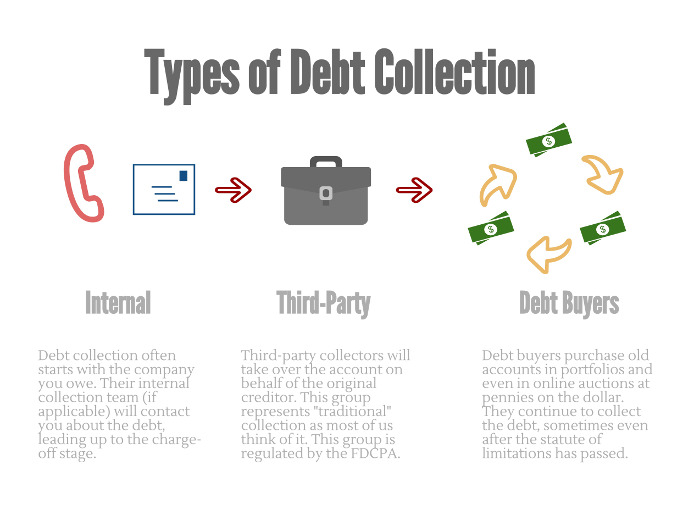

To understand the financing collection procedure, you need to rely on the professionals that are experienced in this area. They have the understanding and expertise to browse the intricate world of financial debt recovery. These professionals comprehend the complexities of the lawful structure bordering loan collection and can supply useful understandings into the very best methods for recovering superior debts.Funding collection is not as straightforward as sending out a couple of suggestions or making a few call. It needs a critical approach, customized to each specific debtor's conditions. The experts have a deep understanding of the different collection methods available and can establish one of the most efficient strategy for every situation.

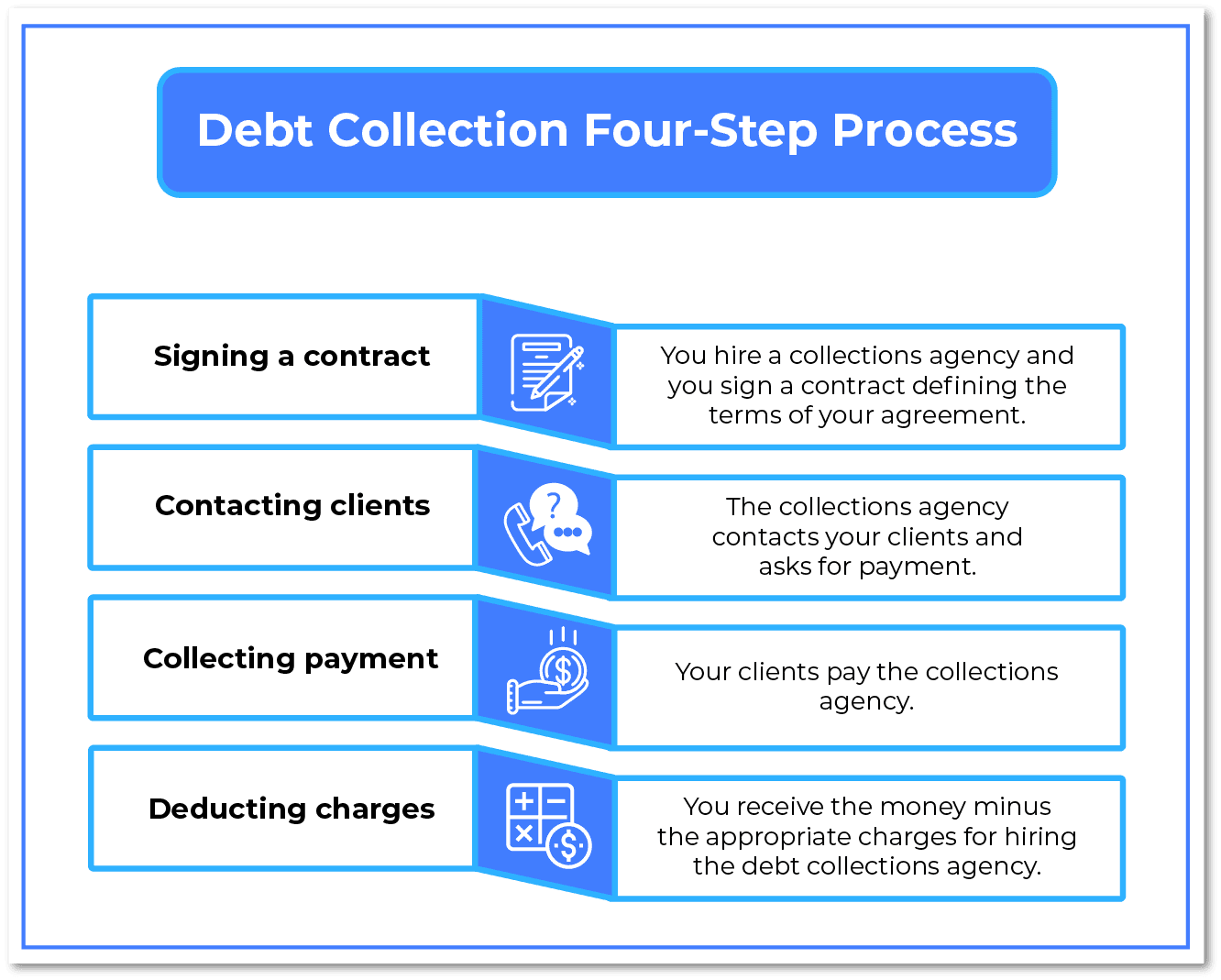

By trusting the professionals, you can make certain that the finance collection procedure is conducted skillfully as well as effectively. They have the needed tools and resources to interact and also locate with borrowers, negotiate settlement terms, and also, if essential, start legal proceedings. Their experience in managing debtors from numerous histories and economic situations permits them to manage each case with level of sensitivity and professionalism and reliability.

Reliable Communication Techniques With Debtors

Reliable interaction strategies with debtors can greatly improve the success of finance collection efforts. By establishing clear lines of interaction, you can effectively communicate vital details and expectations to consumers, ultimately boosting the chance of successful funding settlement. Overall, efficient interaction is the key to successful funding collection initiatives, so make certain to prioritize it in your collection strategies.Executing Settlement Strategies for Effective Financial Debt Recuperation

When executing arrangement methods for effective financial obligation recuperation, you can make use of active paying attention skills to understand the customer's point of view as well as discover equally beneficial solutions. By actively listening to what the customer has to say, you can acquire important insights into their financial situation, reasons for failing, and potential repayment alternatives. This will certainly permit you to customize your settlement method as well as offer suitable solutions that resolve their problems.Energetic listening involves giving your complete interest to the borrower, preserving great eye contact, and staying clear of disturbances. It additionally indicates asking open-ended questions to urge the consumer to share even more information and also clarify their demands. By doing so, you can develop trust and also relationship, which is vital for successful arrangements.

Throughout the negotiation process, it is important to continue to be calm, individual, and compassionate. Understand that the debtor may be experiencing monetary troubles and might be feeling overwhelmed.

Making Use Of Innovation for Efficient Funding Collection

Utilizing modern technology can improve the process of funding collection, making it a lot more convenient as well as reliable for both loan providers and consumers. With the development of innovative software as well a knockout post as online systems, lending institutions can currently automate numerous aspects of loan collection, saving time and sources. By applying digital payment systems, customers can conveniently make repayments from the convenience of their very own residences, removing the demand for physical visits to the lender's office or bank. This not only saves time however likewise minimizes the anxiety and also aggravation linked with typical lending collection methods.Innovation permits lending institutions to check and track funding payments in real-time. Furthermore, digital records as well as paperwork make it much easier to keep precise and also current loan records, decreasing the possibilities of conflicts or errors.

Overall, leveraging innovation in finance collection enhances effectiveness, lowers expenses, and boosts the consumer experience. Lenders can concentrate on various other crucial jobs, while consumers delight in the comfort of digital repayment choices as well as streamlined processes. Embracing technology in lending collection is a win-win for both parties involved.

Best Practices for Legal Actions in Funding Collection

One of the most effective practices for legal activities in financing collection is to seek advice from with seasoned attorneys who specialize in debt recuperation. It is important to have experts on your side that comprehend the complexities of debt collection regulations as well as regulations when it comes to legal issues. These specialized attorneys can offer you with the necessary support and knowledge to navigate the complicated legal landscape as well as ensure that your car loan collection initiatives are carried out within the limits of the regulation.

Additionally, these legal representatives can offer important guidance on alternate disagreement resolution approaches, such as negotiation or mediation, which can help you avoid costly as well as lengthy court proceedings. They can likewise assist you in examining the dangers as well as prospective i loved this results of lawsuits, permitting you to make enlightened choices on exactly how to continue with your funding collection initiatives.

In general, talking to skilled lawyers that concentrate on financial debt recuperation is a vital best practice when it pertains to lawsuits in car loan collection. Their knowledge can ensure that you are complying with the correct lawful procedures and also maximize your possibilities of effectively recovering your loans.

Verdict

By understanding the funding collection procedure, executing efficient communication methods, making use of arrangement techniques, and also leveraging technology, you can improve your possibilities of effective debt recovery. Keep in mind, counting on experts in funding collection can aid you browse the process with confidence and accomplish the preferred end results.Reliable interaction strategies with borrowers can significantly enhance the success of finance collection initiatives (credifin). On the you can try here whole, effective communication is the key to successful lending collection efforts, so make sure to prioritize it in your collection techniques

Report this wiki page